The majority of borrowers of Paycheck Protection Program (PPP) loans will apply for and receive forgiveness of these loans. Ordinarily, a forgiven loan qualifies as income. However, Congress chose to exempt forgiven PPP loans from federal income taxation. In addition, on December 27, 2020, when the Consolidated Appropriations Act for 2021 was signed into law, the law stated that expenses paid for using forgiven PPP loans would be tax-deductible.

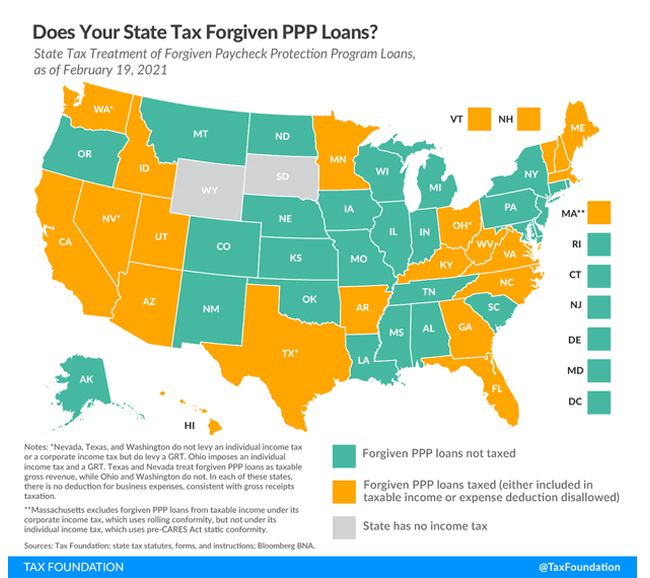

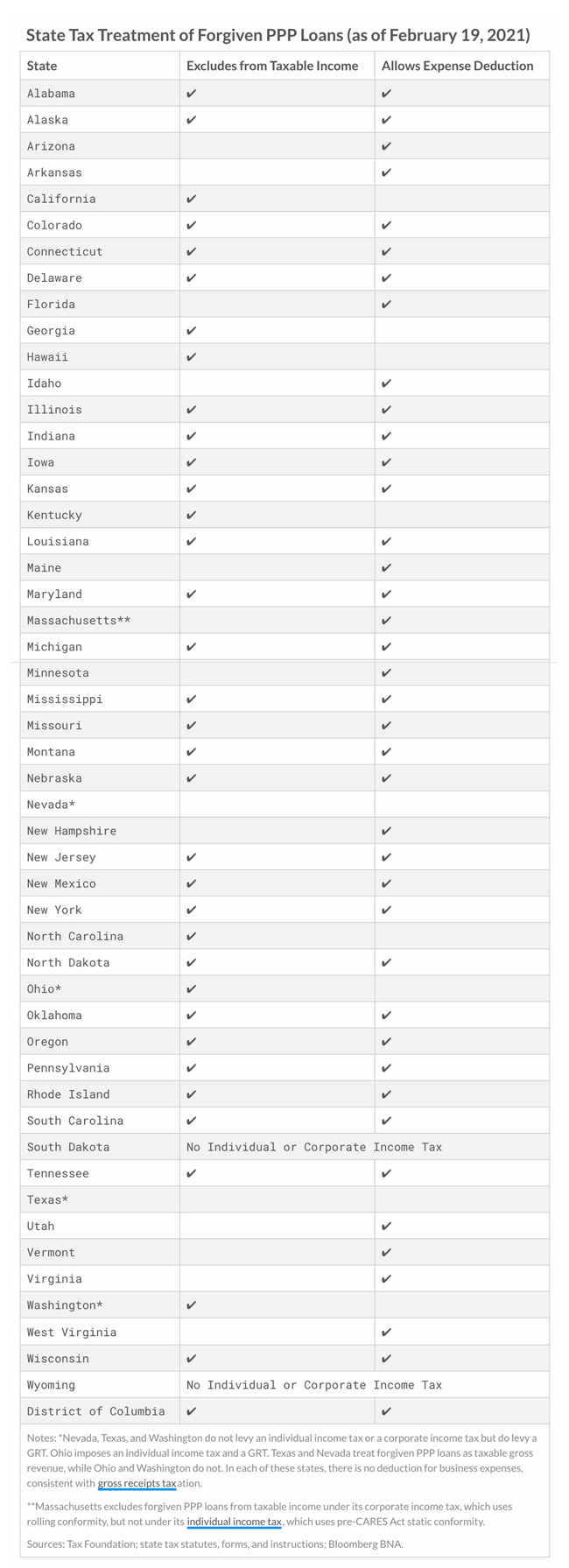

The map and table below show states’ tax treatment of forgiven PPP loans:

Why do states have such different practices when it comes to the taxation of PPP loans? It all has to do with how states conform to the federal tax code. Some states follow IRS guidelines on forgiveness and deductibility of expenses. Others follow either the former, the latter or neither.

See chart below for state tax treatment of forgiven PPP loans:

State policymakers are now in the position to help ensure PPP recipients receive the full emergency benefit Congress intended by refraining from taxing these federal lifelines at the state level. Denying the deduction for expenses covered by forgiven PPP loans has a tax effect very similar to treating forgiven PPP loans as taxable income: both methods of taxation increase taxable income beyond what it would have been had the business not taken out a PPP loan in the first place.

In many states that currently tax forgiven PPP loans, including Arizona, Arkansas, Hawaii, Maine, Minnesota, New Hampshire and Virginia, bills have been introduced to prevent such taxation, and Wisconsin recently acted to do the same.

The information presented here should not be construed as legal, tax, accounting, or valuation advice. No one should act on such information without appropriate professional advice and after a thorough examination of the particular situation.