IRS Audit Rates Continue to Decrease In Many Cases Under 1%

As IRS budgets and audit staff continue to diminish, audit numbers are at an all-time low. To start, individuals get more audits than business and specialty taxpayers.

In 2017, the IRS reported a 1 in 184 (0.542 percent) chance of being audited for all taxpayers. For taxpayers filing individual returns, the likelihood of audit is 1 in 161 (0.623 percent). Corporations (1120, 1120-S) and partnerships are audited less than individuals – with an audit rate of 1 in 224 (0.445 percent). In 2017, the IRS audited only 1 in every 568 (0.176 percent) employment tax returns (Forms 940/941).

Individual return audit rates

Out of the 150 million taxpayers who filed in 2017, here are the IRS statistics on who experienced an audit:

| Form 1040 taxpayer types, in descending likelihood of audit | Returns audited |

| International taxpayers | 1 in 19 |

| Taxpayers with gross income before deductions of over $1 million | 1 in 23 |

| Sole proprietors with gross income before deductions between $100,000 and $200,000 | 1 in 48 |

| Sole proprietors with gross income before deductions between $200,000 and $1 million | 1 in 64 |

| Taxpayers with self-employment income under $25,000 who claim the EITC | 1 in 72 |

| Farmers | 1 in 228 |

| Wage earners who make under $200,000 and don’t claim the EITC (65% of taxpayers fit this category) | 1 in 364 |

The IRS is focusing its audit resources on areas where it knows taxpayers are traditionally noncompliant: small businesses, international taxpayers, high-wealth taxpayers, and possible Earned Income Tax Credit fraud schemes. Traditional wage earners who have traceable income reported on Forms W-2 face much less scrutiny.

Business and specialty tax return audit rates

Out of the millions of returns filed by businesses, employers, and specialty taxpayers (estate, gift, trust returns), here are the IRS statistics on who experienced an IRS audit:

| Business/specialty taxpayer types, in descending likelihood of audit | Returns audited |

| Large corporations (Form 1120, assets greater than $5 billion) | 1 in 3 |

| Estate tax returns | 1 in 12 |

| Large corporations (Form 1120, assets between $10 million and $5 billion) | 1 in 23 |

| Excise tax returns | 1 in 72 |

| Gift tax returns | 1 in 130 |

| Small corporations (Forms 1120, not 1120-S) | 1 in 146 |

| Partnership returns (Form 1065) | 1 in 260 |

| Estate and trust income tax returns (Forms 1041) | 1 in 971 |

| Employment tax returns (Forms 940 and 941) | 1 in 568 |

| S corporation returns (Forms 1120-S) | 1 in 358 |

The IRS questions more returns through automated matching notices

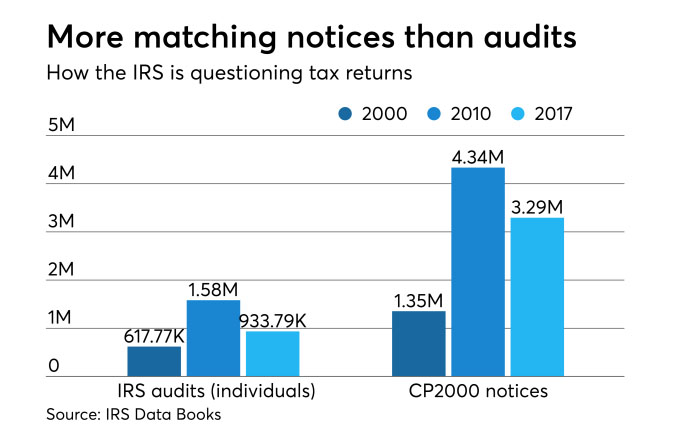

Audits are not the only way the IRS can question the accuracy of a tax return. Over the past 20 years, the IRS has ramped up more automated return checks in the form of matching programs. For example, in the IRS CP2000 program – the automated under-reporter program – the IRS matches income between tax returns and IRS information to look for discrepancies. If there’s a mismatch, the IRS automatically sends out a notice asking for explanation. This program has increased 143 percent since 2000 – and it outnumbered audits 3.1 to 1 in 2017.

Clearly, smaller IRS budgets and personnel over the past seven years have even lowered the number of CP2000 matching notices. But automated notices have become the norm. And although CP2000 notices are not technically IRS audits, they allow the IRS to increase its ability to challenge returns far beyond what it can do through people-intensive audits. Matching notices also feel a lot like an audit for taxpayers. If you add the CP2000 matching program to the IRS “return challenge” rate for individuals, the chances of the IRS challenging an individual taxpayer’s return come out to 1 in 35 instead of 1 in 161.