Using an IC-DISC Structure to Reduce Taxes on Foreign Exports

Companies in the manufacturing industry that are involved in foreign transactions, particularly exporting, need to be aware that they can reduce their U. S. tax liability using an Interest-Charge Domestic International Sales Corporation, more commonly known as an IC-DISC. The IC-DISC is a federal tax export incentive entity structuring available for U. S. companies that export goods and services to foreign countries. An IC-DISC creates the opportunity to tax a portion of export related to profits at lower tax rates, and to potentially defer export related income to future years.

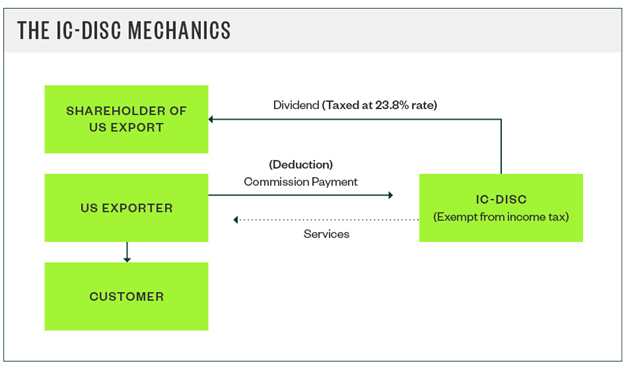

The IC-DISC allows certain U. S. exporters to reduce their overall tax liability through a commission mechanism. The exporter manufacturing company pays a tax deductible commission, based on qualified export sales, to a newly created corporation that makes an IRS election to be an IC-DISC. By design, IC-DISCs are exempt from federal tax, and therefore do not pay tax on the commission received. The IC-DISC then distributes the commission income to the shareholder as a qualified dividend subject to tax at reduced capital gains tax rates.

The IC-DISC entity can be created by the shareholders of the exporter manufacturing company as a brother-sister configuration, typically used when the exporter manufacturing company is a regular corporation for tax purposes. Or, the IC-DISC can be established by the exporter manufacturing company as a parent-subsidiary configuration when the parent exporter manufacturing company is a pass-through type tax entity.

In either case, the benefit received from utilizing an IC-DISC structuring is dependent on the tax structuring and the effective tax rates of the taxpayers involved in the commission transactions. The IC-DISC is not required to distribute its accumulated earnings, allowing for the dividend income to be deferred into future years.

Export sales must meet the following requirements in order to qualify for the IC-DISC benefit:

In addition to export sales of manufactured property, the following transactions may also qualify for IC-DISC treatment:

To be an IC-DISC, a corporation must be organized under the laws of a state or the District of Columbia and meet the following tests.

Mechanics of the IC-DISC